Introduction

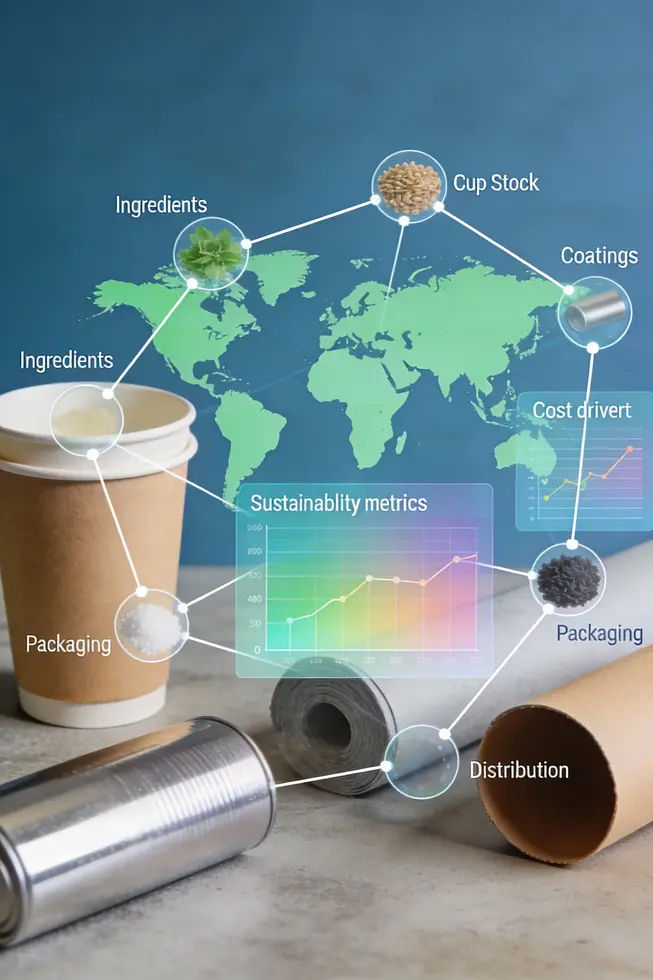

Modern ice cream cup factories sit at the critical intersection of product quality, packaging integrity, and scalable operations. The lesson for business owners is not only how to run a line, but how to design a system where every step—from raw ingredients and pasteurization to aging, freezing, and final cup sealing—contributes to a reliable, safe, and cost-effective product. Today’s facilities blend traditional food-safety disciplines with high-speed automation, smart process controls, and robust packaging engineering to deliver consistent texture, flavor, and presentation across multipleSKU lines. A successful factory must harmonize four core domains: technology and production process, materials and cup design, operational discipline with flavor management and quality systems, and the economics and sustainability of a global supply chain.

In the following chapters, we unpack how each domain underpins performance for a business owner: the technology stack and process flow that turn ingredients into smooth ice cream; the choice of materials, cup construction, and packaging strategies that protect against leaks and freezer burn; the operational practices that govern flavor integrity, batch consistency, and rigorous quality control; and finally the economics, sustainability considerations, and international logistics that shape competitiveness for today’s brands. The goal is practical insight you can translate into procurement decisions, line design, and supplier partnerships that optimize cost, speed, and risk across your ice cream cup program.

Tables of Contents

Chapter 1: ice cream cup factory: Technology and Production Process

- From Foundations to Fulfillment: Technological Foundations, Automation, and Process Innovation in the Ice Cream Cup Factory

- Economic, Geopolitical, and Societal Forces That Shape Ice Cream Cup Technology and Production

Chapter 2: Ice Cream Cup Factory: Materials, Cups, and Packaging Engineering

- Ice Cream Cup Factory: Materials, Cups, and Packaging Engineering — Technological Dimensions, Innovations, and Sustainable Pathways

- From Coatings to Commerce: The Material Landscape and Global Impacts of Ice Cream Cup Packaging

Chapter 3: ice cream cup factory: Operations, Flavor Management, and Quality Control

- Inside the Line: The Synthesis of Operations, Flavor Craft, and Quality Control in the Ice Cream Cup Factory

- Global Winds and Local Flavors: The Economic, Geopolitical, and Societal Currents Shaping Ice Cream Cup Factory Operations, Flavor Management, and Quality Control

Chapter 4: Ice Cream Cup Factory: Economics, Sustainability, and Global Supply Chains

- Ice Cream Cup Factory: Economics, Sustainability, and Global Supply Chains — Technological and Operational Dimensions

- ice cream cup factory: Economics, Sustainability, and Global Supply Chains — Economic, Geopolitical, and Societal Dimensions

Chapter 1: ice cream cup factory: Technology and Production Process

1. From Foundations to Fulfillment: Technological Foundations, Automation, and Process Innovation in the Ice Cream Cup Factory

Modern ice cream cup factories operate as tightly choreographed systems where raw ingredients become packaged delights through a cascade of precisely controlled, tightly monitored steps. At the heart of this transformation lies integrated automation that coordinates multiple subsystems—mixing, heating, chilling, forming, filling, sealing, and packing—into a continuous flow. Each stage is designed not only for product quality but also for hygiene, traceability, and throughput, so that a single line can produce, seal, and prepare tens of thousands of cups per hour with minimal human intervention. This orchestration rests on a foundation of mechanical design, control science, and material engineering that together determine the texture, safety, and shelf stability of the final product.

The journey begins with ingredient preparation and mixing. Raw milk, cream, sugar, milk powder, and stabilizers are metered into mixing tanks where agitators ensure uniform dispersion. The gradual addition of sugar and powders prevents lumping and promotes a smooth, homogeneous base. This stage is more than blending; it is the creation of a stable, flowable matrix that will respond predictably to subsequent thermal and mechanical treatments. Pasteurization follows, typically at 80–85°C for 15–30 seconds, a heat treatment that eliminates pathogens while preserving a clean flavor profile. The pasteurized mix then undergoes high-pressure homogenization, which breaks fat into submicron droplets. The result is a creamier, more uniform texture, a prerequisite for the fine ice crystal formation that characterizes premium ice cream.

After homogenization, rapid cooling to 2–5°C chills the mix quickly enough to suppress large ice crystal formation and begins the aging process. Aging, often spanning 4–24 hours, allows fat crystals to equilibrate and stabilizers to hydrate fully. This step is fundamental to mouthfeel; it prepares the base for the subsequent freezing stage where texture is literally frozen in place. In the continuous freezer, the mix is quickly frozen, scraped to create tiny ice crystals, and simultaneously whipped with sterile air. The air incorporation not only lightens the texture but also contributes to the perception of creaminess without adding excessive fat.

Flavors enter during or just after the freezing stage. Vanilla, chocolate, fruit, and other profiles are introduced in controlled streams that often craft delicate swirls or layered effects as the semi-frozen stream moves toward filling. The result is a mass that remains semi-frozen and manageable by filling equipment while maintaining the ability to form attractive visual textures in the cups. The filling stage is a feat of precision engineering. Automatic cup filling machines transfer the semi-frozen ice cream from the continuous freezer into preformed cups and containers, operating at temperatures around –4°C to –8°C. These machines must handle highly viscous material without compromising sanitation or fill accuracy. Throughput ranges in standard configurations approach several thousand fills per hour, driven by servo-controlled mechanisms and accounts of exact dosing to reduce waste and ensure uniformity across millions of cups.

The cups themselves are the next critical link in the chain. Engineered for durability, they rely on multi-layer constructions—typically heavy-weight paperboard coated on the interior with a barrier layer to prevent leakage and on the exterior to resist condensation and freezer burn. The interior barrier prevents the liquid mix from seeping through to the paper, while the exterior coating keeps the cup rigid and printable even in ultra-cold conditions. Choices in coating chemistry have expanded to include compostable and fully recyclable options, such as PLA or aqueous coatings, reflecting a growing emphasis on sustainability without compromising performance. The cups’ design also factors in print quality and customer branding, which, in turn, can influence the choice of coating, weight, and seal integrity. In practice, this means the packaging engineers must anticipate the full lifecycle of the product—from freezer to consumer hand and beyond.

Post-filling operations seal the product and drive it into hardening tunnels where temperatures plummet to around –40°C. This rapid freezing locks in texture while stabilizing the atmosphere within the cup, ensuring consistent density and mouthfeel across batches. Final packaging and cold storage in transit further safeguard quality, enabling distribution networks to maintain product integrity from factory doors to retail shelves. In facilities designed for maximal flexibility, the same lines can switch between dozens of flavors or several cup sizes with minimal changeover time. Flexible automation enables a single production line to manage up to a dozen different ice cream profiles, varying in fat content, sweetness, and texture, while upholding stringent hygiene and traceability standards.

A modern ice cream cup factory is as much a data-driven enterprise as a mechanical one. Sensors monitor viscosity, temperature, and flow rate; automated cleaning-in-place (CIP) systems maintain hygienic standards without manual disassembly. Real-time dashboards highlight deviations from spec, enabling operators to intervene before waste occurs. Predictive maintenance leverages fault logs and running hours to anticipate equipment wear, reducing unplanned downtime. The result is a plant that can sustain high throughput while preserving product consistency, a dual achievement that hinges on both robust hardware and disciplined process control.

Product variation is a practical inevitability in large-scale manufacturing. The ability to run multiple flavors on a single line requires modular molds, versatile deposit nozzles, and smart recipe management. The automation stack handles flavor routing, batch splitting, and clean handoffs with minimal human adjustment. This capability not only supports brand diversity but also helps manage seasonal demand and promotional campaigns. The entire system is underpinned by careful material selection, hygienic design principles, and a culture of continuous improvement that pushes operators to optimize energy use, minimize waste, and reduce the environmental footprint of the production cycle.

For readers who want a tangible glimpse into packaging options that accompany this high-tech production, think of the broader packaging ecosystem that surrounds the cup. The choice of cups—how they seal, how they withstand freezing, how they print and stack—can be as influential as the recipe itself in determining overall process efficiency. In this regard, packaging innovations often go hand in hand with processing advances. A practical example is the shift toward eco-friendly, printed-logo ice cream cups with lids, which illustrates how sustainability, branding, and performance converge in modern manufacturing. eco-friendly ice cream cups with lids. By linking packaging choices to production capabilities, the factory can optimize line balance, maintain product quality, and deliver an appealing, responsibly packaged product to the consumer.

The integrated automation, coupled with material science and process engineering, thus defines the core of the ice cream cup factory’s technology and production process. This is not merely about making ice cream; it is about orchestrating a complex, hygienic, high-throughput system that reliably converts a recipe into a consistent, crave-worthy cup. Every stage—mixing, pasteurizing, aging, freezing, flavoring, filling, sealing, and hardening—works in concert with the packaging architecture to produce a finished product that travels from plant floor to freezer and beyond, with quality intact at every transition. The result is a factory that can scale, adapt, and sustain, even as consumer tastes shift and global supply chains press for greater efficiency and resilience.

2. Economic, Geopolitical, and Societal Forces That Shape Ice Cream Cup Technology and Production

The factory floor that churns, freezes, and seals ice cream into cups is more than a sequence of mechanical steps; it is a living system embedded in a wider economic, geopolitical, and societal mesh. The technology and production process of ice cream cups respond not only to the physics of mixing, pasteurization, and rapid freezing, but also to the price signals, policy landscapes, and social expectations that govern modern manufacturing. In this light, automation and process optimization emerge as strategic tools that translate volatile inputs—labor, materials, energy—into consistent quality, reliability, and scale. The throughput figures tell a precise story: automated filling lines move viscous product at thousands of units per hour, with uniform fills to minimize waste and maximize yield. Such efficiency rests on a chain of supporting technologies, from food-grade stainless steel hygienic designs to robust robotics and control systems, all calibrated to maintain strict temperature and texture windows throughout the journey from mixer to cup. But technology does not exist in a vacuum. Its trajectory is steered by economic calculus that prizes labor savings, capital productivity, and the ability to offer diverse flavors on a single line. Automation slashes routine labor costs and accelerates order processing, while high-volume printing and coating strategies lower per-unit costs and enable premium branding where it matters most on the retail shelf. In the context of the ice cream cup, these economics translate into decisions about line layout, equipment sourcing, and maintenance regimes that keep a multi-flavor capability synchronized with packaging and filling. Modern factories, particularly in regions with advanced food tech ecosystems, deploy lines that can switch between up to a dozen flavors without sacrificing hygiene or throughput. The result is a production platform that looks less like a single-purpose machine and more like a configurable network designed to capture shifting consumer tastes and seasonal demand. The economic logic is reinforced by the material and packaging choices that cradle the product. Cups made from heavy-duty virgin paperboard, typically in the 200–350 gsm range, rely on a double polyethylene coating to seal in the leak-prone interior while protecting the exterior from condensation and freezer burn. The coating system, integral to performance, affects not only integrity and scooping feel but also end-of-life considerations and regulatory compliance. As sustainability pressures mount, the industry is increasingly weighing alternatives such as PLA compostable or aqueous coatings, which reflect a broader push toward reducing plastic waste without compromising safety or user experience. Printing plays a pivotal role in whether a cup communicates quality or practicality. Offset printing can deliver photographic detail and nuanced branding for premium lines, while flexographic printing provides cost-efficient, high-volume capabilities for solid graphics. The distinction matters: branding on the cup itself becomes a movable billboard, capitalizing on the moment of purchase to reinforce product identity and differentiating a retailer’s offering in a crowded freezer aisle. This convergence of cost, branding, and performance explains why many facilities invest in sophisticated cone and cup molding machinery, designed for varied shapes and sizes, and integrated robotic systems that maintain strict hygienic standards. The capacity to run multiple flavors and cup formats on a single line speaks to a broader industrial logic—one that emphasizes flexibility, uptime, and the ability to weather demand swings without sacrificing quality. Geopolitically, these production strategies tie directly into how supply chains are organized for key inputs: paperboard stock, PE coatings, inks, and the sophisticated machinery that drives automation. Regions with strong food-safety standards and advanced manufacturing ecosystems often become preferred hubs, shaping where lines are sourced, how much inventory is held, and which suppliers are considered strategic partners. Tariffs, trade barriers, and currency movements can ripple through the cost structure, altering the calculus of where to locate new lines or upgrade existing ones. Moreover, the reliance on specialized equipment from technology leaders introduces an exposure to geopolitical tensions that can disrupt uptime, maintenance, or parts supply, underscoring the importance of resilience, inventory buffers, and diversified supplier networks. Societal implications accompany these economic and geopolitical forces. Hygienic, automated designs reduce contamination risks, supporting safer mass production in crowded retail environments. Yet the same automation that safeguards public health also prompts labor market shifts. The deployment of robotic filling and vending-ready systems calls for reskilling, new training programs, and social safety nets to ease transitions for workers in regions where manufacturing jobs have traditionally formed the backbone of local economies. Environmental considerations intensify the debate around packaging. The Double PE coating aids functional performance but raises questions about recyclability and waste management. The industry’s response—ranging from improved sorting and recycling infrastructure to exploration of alternative coatings or recyclable cup materials—reflects a society increasingly attentive to the lifecycle of consumer packaging. In dialogue with these shifts, design and manufacturing choices in the ice cream cup cannot be divorced from marketing and user experience. The cup becomes a vehicle for flavor storytelling, brand recognition, and consumer trust. The trend toward eco-conscious branding is evident in packaging solutions that blend aesthetics with responsibility, including attempts to harmonize convenience with sustainability. For instance, the move toward eco-friendly printed-logo cups with lids demonstrates how packaging design intersects with consumer expectations and environmental commitments, signaling that even in a highly automated, process-driven domain, visual identity remains a critical lever for market success. See a concrete example of this packaging evolution in available cup portfolios that emphasize sustainability without compromising performance. [eco-friendly-printed-logo-ice-cream-cups-with-lid] This convergence of technology, economy, geopolitics, and society ensures that the ice cream cup factory remains both a mechanical workspace and a strategic node in global supply chains. Every upgrade in automation, every choice of coating, and every branding decision reverberates through product cost, customer perception, and regional employment patterns. As markets evolve, the production line will continue to adapt, balancing efficiency with resilience, durability with sustainability, and speed with safety. This integrated perspective helps explain not only how ice cream cups are made, but why the machinery, materials, and methods are perpetually aligned with broader forces steering the industry forward.

Chapter 2: Ice Cream Cup Factory: Materials, Cups, and Packaging Engineering

1. Ice Cream Cup Factory: Materials, Cups, and Packaging Engineering — Technological Dimensions, Innovations, and Sustainable Pathways

Materials define what a cup can endure and how the ice cream inside behaves as it travels from mixer to mouth. In an ice cream cup factory, the choice of substrate and barrier system is not merely a matter of vendors and sheets; it sets the tempo for the entire line. The core substrate typically spans a narrow window of 200 to 350 grams per square meter, a range chosen to balance stiffness, heat handling, and the ability to withstand the rigors of freezing tunnels and long storage. This substrate is rarely used alone. It carries interior and exterior coatings that create a moisture and temperature shield. An interior barrier, most commonly a dual layer of polyethylene, provides leak resistance and prevents the liquid mix from wicking into the paper during assembly and filling. An exterior barrier reduces sogginess and guards the surface against condensation in the freezer, preserving print quality and structural integrity when the cup sits in a low-temperature, high-humidity environment. The conversation around barriers is evolving. Although traditional PE remains a workhorse for its reliability and cost efficiency, there is a growing exploration of plant-based and water-based alternatives. Polylactic acid (PLA), derived from plant material, offers compostability at the end of life but requires careful consideration of industrial composting infrastructure and end-of-life logistics. Aqueous coatings, as a plastic-free option, promise improved recyclability while maintaining a robust moisture barrier. Kraft paperboard, unbleached and naturally strong, appears as another viable path when paired with engineered coatings to meet the same bar- and sog-resistance targets. The configurations vary from virgin kraft with double PE to PLA-lined formats designed for compostability, with eco-lines prioritizing plant-based coatings to align with broader sustainability goals. The central calculus remains: barrier performance, end-of-life options, temperature resilience, and total cost per cup across millions of units. The best configuration must resist leakage from the heavy dairy load during cold storage and preserve insulation during the hot, bustling hours of production, distribution, and consumer handling. In practice, the interior layer is tuned to prevent infiltration and wetting, while the exterior layer guards against condensation and surface weakening. This dual approach ensures the cup remains rigid and printable, even after exposure to freezing temperatures and rapid cooling in the tunnel. The industry has also embraced kraft-based substrates for a natural aesthetic and potential recyclability advantages, provided the barrier system can meet performance requirements. The trade-offs are deliberate. PE-based barriers excel in leak resistance and low-temperature stability, but their end-of-life implications drive interest toward PLA or aqueous systems. Manufacturers assess a matrix of criteria—barrier strength, thermal performance under sub-zero conditions, recyclability, cost, and supply chain reliability—before selecting a cup’s backbone. The material choices ripple through downstream processes, affecting die-cutting precision, heat sealing, and the durability of the finished cup during handling on multi-flavor lines. Manufacturing engineers design lines to accommodate these material differences, ensuring consistent seam integrity and moisture barriers while maintaining high-speed throughput. The cups themselves may be designed as standard single-wall forms or as advanced double-wall configurations. Double-wall cups, sometimes featuring ripples or embossed textures for grip, deliver superior insulation and a secure hold when handling very cold ice cream. To support these designs, feeding and assembly lines require tighter tolerances and more synchronized heating, sealing, and forming stages. The market leans toward customization, with cup sizes tailored to specific brand specifications and chain requirements, which in turn drives tooling changes and line reconfigurations. A cleanroom environment—often aligned with food-safety standards such as BRC—is not merely an aspirational backdrop. It is a practical necessity that helps maintain surface quality, barrier integrity, and hygienic conditions during high-speed production. In parallel, the equipment stack for molding and coating must manage the interactions of hot melts, barrier films, and curved cardboard geometries with precision, ensuring dimensional stability from feed to finish. The manufacturing engineering narrative extends beyond the cup itself to the broader ecosystem of packaging. The industry is increasingly cautious about the plastic footprint of the entire system. While traditional plastic cups dominate in some markets, there is a palpable shift toward alternatives that enhance recyclability or compostability without compromising performance. This shift affects not only the cups but also the way lines are designed and integrated with downstream packaging and waste streams. The supply chain must align raw materials with automated printing, die-cutting, and heat-sealing processes that keep pace with demand while maintaining food-safety compliance. The scale of operation—often measured in hundreds of professionals and dozens of simultaneous machines within expansive facilities—underscores the importance of automation. High-speed flexographic printing and die-cutting, integrated into cleanroom environments, produce consistent cup bodies and printed graphics. Automated sealing completes the moisture barrier while preserving structural integrity through freeze-thaw cycles. The result is not just a cup, but a carefully engineered package that travels a frozen product through pasteurization remnants, rapid freezing, and into consumer hands with minimal risk of leakage, sogginess, or compromised aesthetics. Technological dimensions extend into the realm of process control and quality assurance. Precision in cup dimensions, barrier performance, and insulation is matched by rigorous checks for moisture transfer and structural resilience under freezing conditions. Robotic handling supports accurate cup feeding, assembly, and packaging, reducing human error and elevating repeatability across long production runs. The temperature choreography—from the initial mix handling around 80–85°C pasteurization to rapid freezing with air incorporation and post-freeze handling at sub-zero temperatures—places additional demands on material selection. Barrier layers must sustain integrity while the cup migrates through cooling tunnels and stacks under cold storage. In this evolving landscape, the best practice rests on integrating material science with manufacturing engineering and sustainability strategy. As designers and operators balance barrier performance, end-of-life considerations, and productivity, they craft packaging systems that protect product quality, ease handling, and minimize environmental impact. The choices made in substrate, coatings, and cup architecture reverberate through the entire production process, shaping not only cost and efficiency but also the consumer experience of cold dessert in a reliable, well-engineered cup. For readers seeking a concrete example of the material-to-manufacturing continuum, a reference point exists in the broader catalog of available cup solutions that emphasizes common design features and performance benchmarks in double-wall and barrier-coated cup formats. Double-wall craft paper cups illustrate how a single design can be adapted to multiple sizes and branding needs while maintaining grip, insulation, and compatibility with automated line configurations. This single-page reference helps ground the discussion in a tangible category without anchoring to a single brand, keeping the focus on the evolving technology and sustainability pathways that define the modern ice cream cup factory.

2. From Coatings to Commerce: The Material Landscape and Global Impacts of Ice Cream Cup Packaging

The material choices behind an ice cream cup do more than protect a product; they define the entire lifecycle of the cup—from production floor to consumer hand, from waste stream to potential recycling stream. In the modern factory, the cup is not a mere vessel but a carefully engineered component that negotiates moisture, temperature, mechanical stress, and brand storytelling. The range of paperboard grades and coating systems is therefore a foundational decision, one that shapes costs, line design, and environmental performance long before any flavor is added. Typical containers rely on heavy-duty virgin paperboard in the 200gsm to 350gsm range, but the real decision lies in how that board is treated on the inside and outside. The internal barrier must seal in moisture and prevent leakage before freezing, while the external layer must resist condensation and maintain rigidity in the face of freezer burn. The balancing act between these requirements informs not only durability but also the downstream processes of molding, forming, and sealing on high-speed equipment.

A standard configuration—double polyethylene (PE) coating—has proven its mettle by delivering a reliable moisture barrier from the inner surface outward. The internal PE layer stops liquids from penetrating the paper during the earlier stages of processing, while the external coating protects the cup from condensation that would otherwise weaken its rigidity and mar its surface. The physics of this arrangement are straightforward: the plastic barrier offers a predictable melting point well above typical process temperatures, ensuring the cup retains structural integrity through the cold chain. This predictability makes PE-lined cups the economically attractive option for high-volume producers who prioritize reliability and cost efficiency.

Yet a movement toward sustainability has sparked a reevaluation of materials. PLA-coated cardboard represents a plant-based alternative that supporters argue aligns better with circular economy goals. PLA, derived from renewable resources such as corn starch or sugarcane, provides a moisture barrier while remaining compostable under industrial conditions. The appeal is clear: the cup, along with its lining, can be disposed of in facilities designed to handle bioplastics, reducing dependence on fossil-based plastics and diminishing long-term plastic waste. The transition is not without complexity. PLA cups demand precise heat sealing and stringent quality control to preserve the integrity of the barrier layers, and production facilities often require certification, such as BRC, to ensure compliance with rigorous food safety standards. This increases the upfront investment for manufacturers but can pay off through brand positioning and end-of-life advantages in markets with advanced waste management systems.

A parallel option is an aqueous coating system, a water-based dispersion that aims to deliver a fully recyclable, plastic-free barrier. The aqueous approach strives to minimize reliance on synthetic plastics, aligning with regulatory and consumer calls for greener packaging. The challenge lies in achieving barrier performance comparable to PE or PLA while preserving print quality, sealing reliability, and shelf stability. For some brands, the choice represents a strategic compromise: acceptable performance at a lower environmental footprint, or a premium packaging profile that markets sustainability as a core value. The material decision, then, becomes a signal about a brand’s authenticity and its willingness to invest in a different waste stream.

The packaging dilemma does not end with the cup liner. The coupling of cup material with lid design, printing, and downstream recycling instructions forms a cohesive packaging system. In practice, modern ice cream cup lines deploy a suite of high-speed, precision equipment—exceeding eighty individual machines in some facilities. These include flexographic printers capable of bold branding on curved surfaces, die-cutting and punching units that shape the cups with minimum waste, high-speed cup forming machines, and fully automated packaging lines that seal, stack, and ready the cups for distribution. The complexity of these systems increases when sustainable materials enter the mix; heat sealing programs must be tuned to the specific barrier layer, and quality control must verify barrier integrity after each seal to prevent leaks in the freezer, during transport, or at the point of sale. Such sophistication underscores the need for specialized operators and rigorous process controls, all of which contribute to the overall cost structure but also to reliability and safety in the final product.

Economically, the spectrum of material options maps onto a spectrum of price points and strategic priorities. Standard PE-lined cups offer the most favorable balance for producers seeking scale. They provide durability, cost efficiency, and compatibility with existing machinery and supply chains. In contrast, PLA-lined cups command premium pricing because of higher material costs and the more demanding manufacturing requirements. Brands aiming to emphasize sustainability or to align with premium aesthetics may select PLA or even fully recyclable aqueous-coated options to distinguish themselves in crowded markets. This segmentation enables manufacturers to tailor offerings to restaurant chains, coffee shops, cinemas, and other high-volume channels that pursue different sustainability commitments and budget constraints.

Geopolitically, the packaging supply chain remains concentrated in regions with established infrastructure for packaging production. China, for example, hosts many of the large-scale facilities that integrate coating, forming, printing, and packaging into streamlined lines. The sourcing of PLA adds another layer of complexity, as its feedstocks derive from agricultural commodities such as corn and sugarcane, tying cup availability to global crop markets and the regulatory regimes governing food-contact bioplastics in different regions. Regulatory frameworks—ranging from FDA approvals in the United States to EU standards for food-contact materials—shape material approvals, test requirements, and labeling obligations. Compliance costs rise as markets diverge, pushing producers to maintain flexible supply chains and to invest in traceability and quality assurance measures that reassure customers and regulators alike.

Societal and environmental implications lie at the heart of these material choices. PE-lined cups, though reliable and cost-efficient, pose end-of-life challenges for recycling streams, as plastics mixed with paper complicate standard recycling processes. PLA-coated cups offer a more favorable narrative for waste reduction, supporting composting in facilities designed to handle bioplastics. The trade-off, however, is that compostability depends on context: industrial facilities may be required, and consumer behavior around disposal becomes a critical determinant of environmental outcomes. The shift toward sustainable materials is thus not only a technical transition but a cultural one, prompting brands to educate consumers, align with local waste infrastructure, and participate in broader circular economy initiatives.

In the end, the material, cup, and packaging decisions ripple through every facet of the ice cream cup factory. The choice influences line design, waste streams, regulatory risk, and brand perception. It dictates how quickly a line can switch between flavors or formats, how easily products can be recycled or composted, and how a company communicates its values to customers. This interconnectedness becomes perhaps most visible when a factory explores packaging options that bind form to function and align with market expectations. For a closer look at a typical packaging option, such as ice-cream cup with lid, explore this example: ice-cream-cup-with-lid-2. The field continues to evolve as technology, policy, and consumer values co-create the future of the ice cream cup.

Chapter 3: ice cream cup factory: Operations, Flavor Management, and Quality Control

1. Inside the Line: The Synthesis of Operations, Flavor Craft, and Quality Control in the Ice Cream Cup Factory

The ice cream cup factory operates as a tightly choreographed system where speed, hygiene, and precision intersect to produce a reliable, appealing product at scale. The journey begins with raw material preparation including milk, sugar, stabilizers, and milk powder blended in agitation to ensure a uniform baseline. Pasteurization follows at typical temperatures around 80-85°C for 15-30 seconds to ensure safety while preserving fats and proteins. High-pressure homogenization then reduces fat particle size for a smooth mouthfeel. After pasteurization the mix is cooled to near refrigeration and aged at about 4°C to optimize crystallization and flavor buffering. From aging the line moves to freezing in a continuous freezer, where the mix is rapidly frozen and scraped, with sterile air incorporated to create a light, creamy structure. The flow proceeds to packaging: the viscous yet scoopable mix is deposited into preformed food-grade cups, typically with interior and exterior coatings to prevent leaks and condensation. Hygienic stainless steel surfaces and cleanable equipment minimize contamination risk on all product-contact parts. After filling the cups enter a hardening tunnel at around -40°C to lock in texture, followed by sealing and packaging for cold-storage dispatch. Visual and dimensional checks, temperature monitoring, and fill verification run in real time to ensure consistency across batches and flavors. Modern packaging must withstand freezing and transport while enabling branding, print quality, and sustainability considerations. Flavor management adds variety through post-aging flavoring, inclusions, and precise dosing, enabling multi-flavor runs on a single line. Quality control remains the backbone, with validated cleaning cycles, real-time checks, and cold-chain monitoring that protect texture, taste, and safety from raw milk to retailer.

2. Global Winds and Local Flavors: The Economic, Geopolitical, and Societal Currents Shaping Ice Cream Cup Factory Operations, Flavor Management, and Quality Control

The ice cream cup factory sits at a crossroads where money, policy, and people converge. Beyond the roar of conveyors and the precision of filling rigs, markets, politics, and social expectations steer how these facilities invest, operate, and steer their product toward ever-shifting shelves. Economic forces set the cadence of production choices. In this space, standardization does more than simplify logistics; it underpins margin recovery in a market where packaging is a battlefield of cost, performance, and sustainability. Factories balance the need for bulk efficiency with the demand for customization. Minimum order quantities, upgradeable to digital printing for small runs, shape a supplier’s willingness to accommodate brand differentiation while preserving scale benefits. The economics of packaging materials—coatings, barrier layers, and the move toward mono-materials—directly influence both cost and flavor fidelity. When a brand seeks a premium look or a recyclable solution, the choice of cup substrate, ink system, and lid design becomes a multi-year investment decision, not a one-off design tweak. The result is a delicate calculus: how to deliver eye-catching branding and reliable barrier performance without inflating unit costs beyond a retailer’s tolerance or a consumer’s willingness to pay.

Geopolitics threads its own set of constraints through the supply chain. Raw materials for coatings and laminates migrate across borders, tying a factory’s fate to regulatory harmonization, trade flows, and environmental mandates. The push toward recyclable and compostable packaging intensifies these links, because sustainable formats require compatibility with recycling streams and standards that vary by region. In fast-moving markets—where cold-chain logistics and e-commerce demand rapid turnover—regions with robust infrastructure and clear regulatory guidance attract investment. Conversely, disruptions in one corridor—whether due to tariff shifts, supply interruptions, or shifting environmental rules—remap capital allocation. Alliances between suppliers and manufacturers become strategic terrain: the ability to source qualifying materials, to access regional packaging innovations, and to comply with labeling and food-safety requirements is as critical as the machinery on the line. That geopolitical awareness also feeds into risk planning, from contingency sourcing for coatings to diversifying regional production hubs so a single disruption does not derail a brand’s entire lineup.

Societal expectations have grown into a powerful market force. Consumers no longer view packaging as a mere container; they judge it on sustainability, recyclability, and perceived safety. The industry’s response has been to tilt toward biodegradable or fiber-based substrates and to pursue coatings that meet food-contact standards while minimizing off-tastes. Yet this shift is not free of trade-offs. Plant-based or water-based coatings can influence flavor perception, moisture barriers, and shelf stability if not carefully engineered. The challenge is to maintain flavor integrity while reducing plastic burden. In this tension between eco-claims and sensory quality, flavor management becomes a crucible. Factories pursue material neutrality in the barrier system to prevent moisture, fat migration, or odor transfer that could contaminate batches. When a single production line handles multiple flavors—up to a dozen on high-tech campuses—the need for rapid cleaning, ingredient isolation, and flavor-specific molding grows more urgent. Premium brands push for laminated or metallized finishes that deliver excellent thermal protection and an artisanal aura, even as retailers demand easier recycling. The result is a packaging ecosystem in which aesthetic and functional performance must coexist with environmental responsibility.

Flavor management, in this context, becomes a strategic discipline rather than a mere recipe exercise. The choice of cup design, coating, and printing inks must survive cold-chain conditions without imparting flavors or compromising print quality. The interplay between cup integrity and flavor fidelity drives decisions about substrate thickness, rim design, and lid compatibility. The standardization of rim diameters, a practical detail in many operations, supports a single-lid ecosystem that cuts storage costs and simplifies logistics across product tiers. This standardization also helps keep line speeds high while allowing rapid portfolio shifts in response to consumer demand or seasonal promotions. In tandem, the cultural and culinary signals embedded in flavors—vanilla, chocolate, fruit-forward profiles, or indulgent textures—are managed through controlled aging, precise blending, and validated process controls that preserve texture and mouthfeel at scale.

Quality control remains the unifying thread through these economic, geopolitical, and societal currents. Certifications such as quality-management standards and food-safety regimes anchor the factory’s credibility in global markets. Inside, hundreds of calibration checks, material traceability, and process validations ensure that every batch meets defined specifications for safety, consistency, and performance under extreme cold. Innovations in packaging—leak-proof rims, resealable features, and cold-stable adhesives—contribute to product isolation and shelf stability, reinforcing the consumer promise of reliability from shelf to spoon. Regulatory compliance—ranging from food-contact materials to labeling disclosures—frames daily routines, supplier audits, and facility design decisions. And as the packaging landscape shifts toward recyclable mono-materials, the factory’s ability to source compliant, high-performance substrates becomes a strategic differentiator rather than a cost center.

In this intricate ecosystem, the economics, geopolitics, and social values of packaging converge to shape every facet of the ice cream cup factory. The plant becomes more than a site of production; it is a living node in a global conversation about sustainability, competitiveness, and consumer delight. As brands navigate the trade-offs between cost, performance, and planet-friendliness, the factory’s capability to harmonize operations, flavor management, and quality control under these wide-ranging pressures will determine not just success in the marketplace, but the endurance of the ice cream cup as a preferred vehicle for creaminess across regions and cultures. For readers seeking concrete examples of how these dynamics manifest in practice, an exploration of sustainable cup options and their sourcing narratives can illuminate the path forward. [eco-friendly printed-logo ice cream cups with lid](https://cofe-cup.net/product/senang07-eco-friendly-printed-logo-paper-ice-cream-cups-with-lid-ice-cream-paper-bowl-paper-ice-cream-cups-with-lid/]

Chapter 4: Ice Cream Cup Factory: Economics, Sustainability, and Global Supply Chains

1. Ice Cream Cup Factory: Economics, Sustainability, and Global Supply Chains — Technological and Operational Dimensions

The technological and operational dimensions of an ice cream cup factory sit at the heart of a complex system where economies of scale meet meticulous process control, sustainability commitments, and resilient global logistics. To understand how this system aligns with broader economic forces, it helps to trace the factory floor from the moment ingredients are brought into the mix to the final seal of each cup. The production line is not merely a sequence of tasks; it is an integrated network where instrumentation, automation, and material science converge to produce a consistent product while curbing costs and reducing environmental impact. Core to this convergence is the way a modern plant balances speed with precision. Mixing and preparation stages rely on carefully controlled temperatures and timings to ensure safety and texture. Pasteurization at elevated temperatures for a defined window eliminates pathogens, while homogenization removes fat separation, setting the stage for a uniform mouthfeel. Cooling to near freezing and aging in controlled tanks stabilize the emulsion before it enters the freezing and aeration phase. In a continuous freezer, the interplay of rapid freezing, surface scraping, and sterile air incorporation sculpts tiny ice crystals and a light, creamy body. This combination of rapid thermal processing and mechanical control is essential; it minimizes ice crystal growth, preserves smoothness, and supports repeatability across millions of cups that enter the market each day.

From there the process moves toward flavoring and filling, where precise dosing into preformed cups and automatic sealing determine product consistency and line efficiency. The challenge for operators is to maintain accuracy while accommodating a spectrum of flavors and mix-ins, all within the same line or across parallel lines in multi-flavor facilities. This necessitates not only reliable metering and flow control but also robust CIP (clean-in-place) routines and sanitary design principles that prevent cross-contamination. In practice, these considerations translate into sensors, automated valves, and programmable logic controls that monitor viscosity, temperature, and fill weight in real time. The result is a reliable throughput that supports high-capacity production without sacrificing product integrity or safety.

Packaging plays a pivotal role in both performance and sustainability. Cups are engineered from paperboard in the range of 200-350 gsm, with interior coatings to prevent leaks and exterior layers designed to withstand condensation and freezer conditions. The coatings themselves are a focal point for sustainability strategy, with a growing preference for compostable or recyclable alternatives where feasible, alongside conventional barrier coatings that still underpin performance. The choice of material feeds directly into recycling streams and end-of-life outcomes, shaping a plant’s environmental footprint and its regulatory risk profile. As consumer expectations shift toward low-plastic or plastic-free solutions, manufacturers increasingly evaluate boards and coatings through the lens of life-cycle impact and recyclability certifications. The plant, therefore, becomes a theater for material science as much as manufacturing engineering, where the balance between heat-seal reliability and recyclability must be optimized for each regional market.

Beyond the line, automation scales the business in ways that extend from efficiency to supplier collaboration and resilience. Multi-flavor lines on single or nearby lines enable a factory to offer a portfolio that ranges from classic vanilla to more adventurous profiles, while maintaining strict hygiene standards and minimizing downtime between product changes. The operational architecture is supplemented by stringent quality systems and traceability protocols, ensuring that every batch can be linked to its raw materials, mixing conditions, and process parameters. ISO 9001:2015-style quality management frameworks underpin these capabilities, delivering standardized procedures for supplier audits, process control, and continuous improvement.

The economics and resilience of the ice cream cup ecosystem are inseparable from global supply chain dynamics. Asia remains a critical growth axis, where rapid urbanization, youthful demographics, and expanding mid-market segments drive demand for convenient, on-the-go formats. This demand pressures both margins and lead times, prompting strategic manufacturing footprints and cross-border collaboration that can reduce logistics costs and shorten time-to-market. In practice, manufacturers pursue vertical integration or semi-integrated models that span ingredients, equipment, and packaging. Such structures can improve lead times, enhance quality control, and buffer the business against disruptions in one part of the chain, whether caused by macroeconomic shifts, regulatory changes, or environmental events.

Disruptions and cost pressures are not merely challenges; they catalyze material choices and process innovations. Regulations targeting plastic waste spur the adoption of compostable coatings and recyclable cup designs, while certification frameworks such as compostability standards or forest-certification programs push suppliers toward more responsible sourcing. Traceability becomes a strategic asset, enabling companies to verify material provenance and ensure compliance across international markets. Partnerships with cup manufacturers or OEMs emphasize not just cost reductions via bulk pricing, but also waste-minimization practices consistent with a circular economy approach. The result is a supply network that can adapt to policy shifts and consumer expectations without eroding profitability.

Strategic investments in Asia and other high-growth regions reinforce a broader narrative: production ecosystems are increasingly integrated across borders to deliver end-to-end supply coverage, from ingredients to cups to final packaging. Cross-border alliances, joint ventures, and equity stakes help to align incentives around quality, lead times, and sustainability targets. Growth drivers include premiumization of ice cream formats, rising disposable incomes, and the expansion of edible or biodegradable options that appeal to environmentally conscious consumers. In this environment, technology and operations become sources of competitive differentiation. The factory must not only be efficient but also agile, capable of scaling up to seasonal peaks, accommodating new flavors, and adapting to evolving regulatory and consumer landscapes without compromising safety or environmental goals.

The subchapter can point readers toward practical touchpoints for future considerations, including supply chain architecture, risk management, and certification strategies that harmonize with global buy-in for sustainable packaging. For a tangible example of how suppliers are supporting sustainability on the packaging front, see the industry discussions around eco-friendly packaging options and lid-compatible cup configurations, which illustrate how materials, coatings, and design choices intersect with recycling infrastructure and consumer convenience. eco-friendly-printed-logo-paper-ice-cream-cups-with-lid

Together, these technological and operational dimensions illuminate how an ice cream cup factory translates macroeconomic signals into scalable processes, resilient supply chains, and sustainable products. The next subchapter will widen the lens to examine how technology and production processes intersect with economic, geopolitical, and societal implications—an exploration that will connect the factory floor with markets, policy, and everyday consumer experiences.

2. ice cream cup factory: Economics, Sustainability, and Global Supply Chains — Economic, Geopolitical, and Societal Dimensions

The economics of ice cream cup production sits at the intersection of consumer demand, packaging innovation, and operational discipline. The packaging segment remains a robust growth engine within the broader ice cream industry. For instance, market estimates show that the global ice cream sticks market was valued at USD 390.72 million in 2025 and is projected to reach USD 655.5 million by 2034, advancing at a steady CAGR. These figures underline how cups and their associated packaging materials are not simply containments but active drivers of product quality, shelf life, and brand identity. Across regions, even as flavor profiles shift and premiumization rises, the need for reliable, cost-competitive cups remains constant. On the consumer side, markets like the United Kingdom have demonstrated sustained expansion in ice cream sales, with industry valuations reaching USD 1.8 billion in 2024 and projecting a climb to USD 3.0 billion by 2033 at a healthy CAGR. Such momentum translates into continuous demand for packaging that preserves texture, prevents leaks, and withstands freezing, while enabling eye-catching branding. In this environment, cup manufacturers must balance material costs with price sensitivity among shoppers, especially during periods of economic flux, to safeguard margins without sacrificing quality.

Automation and digital monitoring have become central to sustaining profitability at scale. Modern facilities leverage automated molding, coating, filling, and sealing along with remote monitoring to maintain consistent output and hygiene across shifts. This capable orchestration lowers on-site labor requirements while enabling rapid production adjustments in response to flavor changes or capacity swings. In practice, the ability to run multiple flavors on a single line, coordinate packaging formats, and maintain tight process control reduces waste and improves overall yield. The result is a leaner cost base and more predictable unit costs, which helps producers weather fluctuations in raw materials such as sugar, dairy, and paper stock. The economics of scale are thus reinforced by data-driven operations, enabling cup manufacturers to offer competitive pricing without eroding quality.

Sustainability pressures are reshaping the materials and configurations of ice cream cups. Regulators around the world have intensified scrutiny of plastic waste and packaging life cycles, prompting a shift toward more sustainable sourcing and end-of-life solutions. In response, the market is accelerating collaboration with OEM paper cup manufacturers and exploring compostable or recyclable coatings. This pivot is not merely an environmental duty; it aligns with brand strategy and consumer expectations for responsible sourcing. Plant-based ingredients and alternative dairy products are also expanding the menu of permissible formulations for cups and cones, creating latent demand for packaging that aligns with health-conscious and eco-aware preferences. As consumers become more attuned to the environmental footprint of their foods, the packaging decision becomes a visible expression of a company’s values, influencing loyalty and willingness to pay a premium for sustainability.

The global supply chain for ice cream cups is a tapestry of interdependencies, risk management, and regional opportunity. Large manufacturers rely on an integrated network of equipment suppliers, raw material providers, and packaging converters spread across continents. Market leadership in one region can hinge on access to the right film, coating, or paper stock, all while maintaining the agility to respond to demand spikes or disruptions. This mosaic is increasingly important in Asia, where rapid economic growth and a youthful consumer base are expanding the soft serve and cup packaging market. Strategic alliances and cross-border investments—such as capital and business collaborations between major firms—illustrate how integrated supply chain solutions can unlock resilience and speed to market. Diversification of suppliers and geographic footprints reduces exposure to single-point failures, as seen in the importance of having multiple sourcing options for both substrates and finished cups. In this context, firms are not just building buffers against disruption; they are constructing ecosystems that support innovation, customization, and regional adaptation.

Geopolitically, these dynamics intersect with shifts in trade policies, currency movements, and regional manufacturing incentives. The concentration of a sizable share of production capacity in particular markets can raise vulnerability to localized shocks, while diversified networks mitigate risk and enable more stable pricing across cycles. The Asia-Pacific region, buoyed by demographic trends and rising disposable incomes, represents a growth engine for cup manufacturers, yet it also demands careful coordination with local suppliers, regulatory standards, and consumer preferences. International partnerships and joint ventures thus serve dual purposes: they accelerate access to new markets and distribute risk across a broader set of collaborators.

The societal dimension of this industrial complex rests on more than job creation. Automation improves process consistency and hygiene, but it can also reshape local employment landscapes. Communities connected to packaging plants may experience both opportunity and disruption as facilities upgrade equipment or expand capacity. At the same time, industry narratives increasingly foreground the responsibilities of manufacturers to reduce environmental burdens, provide transparent supply chains, and engage with stakeholders on sustainable practices. Consumers judge brands by their packaging choices, and a company’s reputation for eco-friendly materials, recyclability, and clarity about end-of-life options can influence shopping behavior as much as taste and price.

For brands seeking a clearer view of packaging options and customization potential, the market presents an accessible入口 into practical choices. See the cofe-cup shop for a catalog of configurations, coatings, and sizes that align with sustainability goals and regional regulatory requirements. cofe-cup.net/shop/

Together, these economic, geopolitical, and societal threads weave a story of an ice cream cup industry that is both highly transactional and deeply strategic. The cups that cradle a beloved frozen treat are not just passive containers; they are instruments of cost control, regulatory compliance, brand storytelling, and social responsibility. As markets evolve, producers must navigate price volatility, supply chain fragility, and growing expectations for sustainable packaging. The capacity to integrate technology, governance, and stakeholder engagement within supply chains will determine which players not only survive but thrive in a world where every cup is a signal of a company’s values and a lever for its bottom line.

Final thoughts

A high-performing ice cream cup factory is not just a single line but an integrated system that aligns technology, materials, operations, and economics around a single objective: reliable, high-quality cups that protect frozen dessert from churn to cup. By combining automated process control with robust cup engineering and disciplined flavor management, business owners can achieve scalable production, reduce waste, and build resilient supply chains. The most successful operators continuously benchmark line performance, invest in sustainability, and cultivate supplier partnerships that support rapid change—whether introducing a new flavor line, migrating to compostable cup variants, or expanding to new markets. The payoff is clear: consistent product experience for customers, lower total costs per cup, and stronger competitive differentiation in a crowded market.

Choose our reliable disposable tableware and packaging solutions for your business. We offer quality products that meet safety standards, with fast delivery and flexible options. Partner with us today to elevate your service – contact our team now for a tailored quote!

About us

We specialize in manufacturing and supplying disposable tableware, packaging paper, and boxes. With years of experience, we prioritize safety, durability, and eco-friendly practices. Our goal is to provide businesses with trusted, cost-effective solutions backed by responsive customer support.