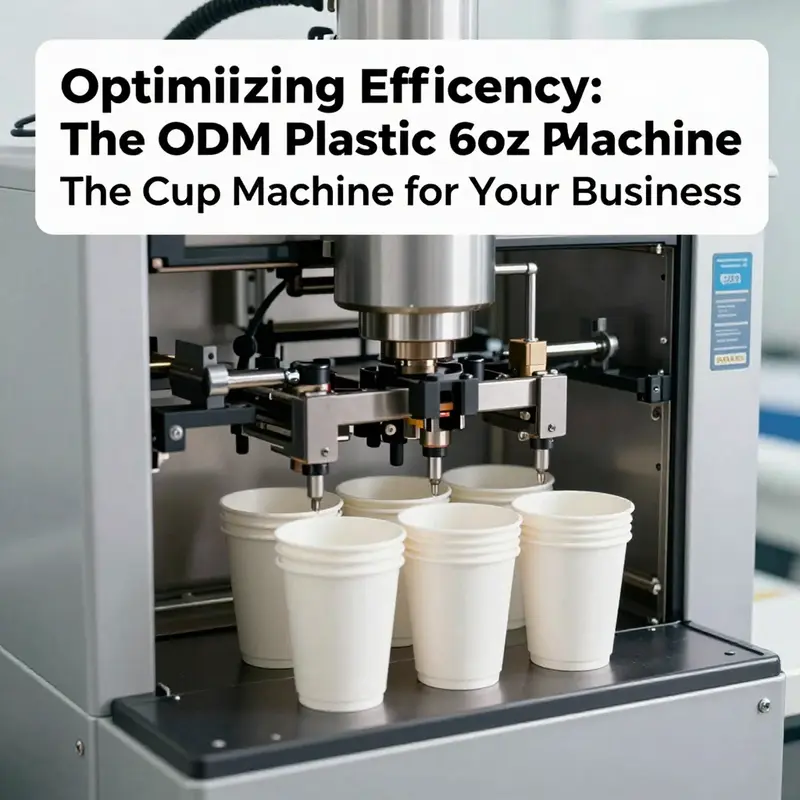

The rising demand for convenient and hygienic disposable tableware has created new opportunities for businesses like bubble tea shops, restaurants, food trucks, and catering services. Central to these developments is the ODM Plastic 6oz Cup Machine for Disposable Bowl. This machine not only provides efficient production capabilities but also caters to an evolving market shaped by consumer preferences. In this discussion, we will explore the technological aspects that make this machine a valuable asset, analyze its economic implications for various businesses, address environmental concerns, and delve into current market trends shaping its utilization. Each chapter highlights how this machine’s benefits align with your operational needs and consumer expectations.

null

null

Chapter 2: The Economic Engine Behind ODM-Driven Disposable Bowl Production

The shift toward ODM, or Original Design Manufacturer, solutions in disposable tableware production marks more than a technological upgrade; it signals a fundamental rethinking of cost structures, risk management, and competitive strategy. In a market where convenience and hygiene propel demand for single-use bowls and cups, an automated forming system designed to produce these items at scale can reshape a manufacturer’s financial profile. The core economic implications emerge not from a single capability but from how automation, customization, and after-sales support converge to alter both the upfront and ongoing costs of operation. What follows is a narrative that threads through throughput, investment decisions, product flexibility, and the broader market forces that shape profitability in ODM-driven disposable bowl production. It remains a story of how capital equipment design influences business outcomes, even as raw materials, labor, and regulatory pressures press for continual adaptation.

At the heart of this transformation is automation’s promise of scale. Machines in this category are engineered to shape and form disposable tableware with precise control over shape, thickness, and edge quality. Their operation hinges on a tightly orchestrated combination of pneumatic and servo-driven mechanisms, which translate raw plastic sheets or resins into finished forms with remarkable repeatability. When cycles per minute rise, even modest improvements in throughput translate into meaningful reductions in per-unit labor and energy costs. In practical terms, high automation means fewer workers required to monitor, adjust, and complete each cycle—especially during long shifts or peak production periods. The result is a leaner labor footprint that preserves staffing for value-added tasks such as maintenance checks and quality audits. The economic logic is straightforward: higher output with consistent quality drives lower unit costs, provided waste is kept under control and downtime is minimized.

A key dimension of that efficiency is standardization. ODM equipment is pre-designed to be robust across a range of common product specifications, reducing the engineering burden that comes with bespoke machinery. For a producer contemplating entry into disposable bowl manufacturing, this standardization lowers the barrier to market entry. Instead of bearing the full weight of research, development, and prototyping, a manufacturer can deploy a proven platform and tailor only the molds, cut profiles, or branding elements needed to align with target segments. The practical upshot is a shorter time-to-market and more predictable capital expenditure. In the long run, standardization also dampens the risks associated with process variability, which can otherwise erode margins through scrap rates and rework. In an industry where even small gains in material yield can translate into significant savings, consistency is a strategic asset.

The economics of ODM equipment extend beyond the initial purchase price. For many producers, the total cost of ownership includes not only the sticker price but also energy consumption, maintenance, warranty coverage, spare-part availability, and the cost of downtime. Similar automated forming systems in adjacent segments have demonstrated a broad cost band for entry—often in the tens of thousands of dollars per setup—with the potential for rapid payback when operating at scale. The affordability of an ODM platform—relative to fully bespoke machinery—reduces the financial risk of experimentation, enabling smaller players to compete with larger incumbents on price and customization. The affordability argument strengthens when considering the lifecycle: with a multi-year warranty window and a network of service providers, the machine’s reliability profile translates into dependable production and steadier cash flow. In markets where demand can ebb and surge with events, promotions, or seasonal hospitality activity, that reliability becomes a competitive differentiator as much as the technology itself.

Customization, once the preserve of bespoke equipment, is now a strategic lever built into the ODM model. The same mold families and forming stations that drive unit economics also enable rapid adaptation to changing consumer preferences. A manufacturer can switch between product formats, sizes, or branding without sacrificing the efficiency of the core platform. This flexibility is especially important in a landscape crowded with private-label brands, promotional partnerships, and regional taste variations. The ability to embed logos or distinctive colorways, update logos mid-cycle, or introduce limited-edition designs within seven days or less—an approach echoed in industry practice—reduces time-to-sale and can command premium pricing in certain segments. The economic payoff comes not only from higher margins on customized runs but also from the reduced risk of obsolescence. Instead of committing to a single product line for years, a company can respond to market signals with agility, turning product mix adjustments into profit opportunities rather than sunk costs.

However, the ODM route is not merely a matter of upfront economics. Ongoing costs—energy usage, maintenance, and downtime—are crucial components of the financial picture. The electricity and air compression demands of modern forming systems are nontrivial. In comparable equipment, power consumption can span a broad range depending on the number of forming heads, cycle frequency, and the complexity of the mold. When scaled across a full production shift, even small percentage differences in energy efficiency accumulate into meaningful annual savings. Maintenance schedules, expected wear on seals and actuators, and the availability of trained technicians all influence uptime and, therefore, the machine’s capacity to deliver projected throughput. A supplier’s after-sales package—training, spare parts, field installation, and timely service interventions—becomes a central element of the business case. Downtime carries a cost that can be difficult to recover through price alone, so a robust service network and clear escalation protocols are as economically important as the machine’s reach and speed.

The financial logic also hinges on how materials costs behave in concert with equipment capabilities. The plastics used for disposable bowls and cups come in a spectrum of prices and performance properties. Materials that offer better strength at thinner gauges can reduce raw material consumption and waste, improving overall yield. But these gains must be balanced against the potential for tighter tolerances or more expensive resins that might demand process refinements or longer cycle times. ODM platforms attenuate these tensions by supporting precise process control and mold design that can optimize material use across a family of products. In effect, the same platform that handles a standard 6-ounce cup can often accommodate related formats with only changes to the mold, trimming tools, and alignment settings. This shared infrastructure reduces incremental capital outlays when product portfolios expand, enabling a more versatile manufacturing footprint without a proportional rise in capital expenditure.

From a strategic standpoint, ODM equipment changes how a company views market risk. Because the platform is designed for broad applicability rather than a single, narrow specification, manufacturers can diversify their product mix without incurring prohibitive retooling costs. The ability to adjust volume and variety in response to demand swings translates into more resilient cash flow. In periods of supply chain volatility, such resilience is valuable. A plant that can scale up for high-volume promotional campaigns or scale down when demand contracts reduces the financial exposure associated with fixed overheads and inventory carrying costs. The pricing strategy also benefits from customization capabilities. Standardized base products can be offered at competitive baseline prices, while premium branding or limited-edition runs can support higher-margin SKUs. The upshot is a more nuanced portfolio that can exploit different margin opportunities across seasons and regions.

To illustrate how these factors converge, consider the investment decision framework that manufacturers often apply to ODM platforms. Initial capital outlay is evaluated alongside expected throughput, labor savings, and maintenance costs. The expected payback period depends on the machine’s ability to deliver consistent quality with minimal downtime and to support a flexible product mix without requiring major retooling. Financing arrangements, including leasing options and vendor-supported service packages, may extend the affordability window and convert capital expenditure into operational expenditure in ways that align with company cash flow objectives. In markets where price competition is intense, even modest improvements in unit cost can translate into meaningful market share gains. Conversely, if material costs rise or regulatory constraints tighten around single-use plastics, the ODM strategy must adapt—by shifting to recyclable or compostable resins, optimizing waste streams, or carrying out more aggressive changes to mold design to preserve margins.

Beyond the numbers, there is a narrative about risk and reliability. An ODM platform embedded in a well-supported supplier ecosystem offers more predictable performance than a bespoke, unrehearsed automation build. The supplier network frequently includes not only the machine manufacturer but also certified installers, spare-part distributors, and remote diagnostic capabilities. This ecosystem reduces the probability that a technical setback escalates into a full production halt. In turn, that reliability reinforces the business case for automation, since the value of throughput is only realized when uptime is maximized. The incremental cost of a robust warranty and a responsive service tier appears small when weighed against avoided downtime and the possibility of late-stage production delays that compromise key customer commitments. In effect, the economic argument for ODM is a balancing act: it weighs upfront affordability, ongoing operating costs, and the intangible but crucial factor of supply chain resilience.

The practical implications for manufacturers extend into the supplier landscape and market access. For small to mid-sized producers, ODM platforms can open doors to contract manufacturing opportunities that require shorter lead times and flexible scale. For larger players, ODM platforms can extend capacity and enable rapid market experimentation without sacrificing efficiency in core operations. In both cases, the ability to iterate quickly on form, branding, and product configuration without incurring prohibitive retooling costs becomes a strategic advantage. This advantage translates into a more dynamic competitive posture, where the emphasis shifts from building bespoke automation to curating a flexible manufacturing backbone that can adapt to shifting consumer preferences and regulatory cues.

For readers who want to situate these ideas within a broader ecosystem, consider how the disposable tableware landscape is evolving in response to sustainability concerns and evolving consumer behavior. Companies are increasingly evaluating the environmental footprint of single-use items and seeking ways to balance convenience with responsible material choices. ODM platforms are part of this dialogue insofar as they enable experimentation with alternative resin systems, improved material utilization, and tighter integration with recycling streams. The technology does not absolve manufacturers from confronting environmental constraints, but it does provide a more adaptable toolkit for responding to them. In a world where regulatory landscapes, customer expectations, and material costs can swing in unfamiliar directions, having a versatile, well-supported forming platform can help maintain profitability without compromising on quality or speed.

As this chapter closes on a synthesis of economic variables, it is worth noting a concrete pathway through which manufacturers can deepen their strategic ROI. The integration of product customization within an ODM platform should be treated not as a peripheral feature but as a core capability. The capacity to deliver branded, differentiated runs at market pace supports value capture across segments—from value-conscious hospitality operators to premium, branded foodservice programs. The synergy between streamlined production and flexible design reduces the friction of introducing new SKUs and speeds up the supply chain’s feedback loop, allowing design iterations to flow through to end users with lower risk and cost. In the end, the economics of ODM-driven disposable bowl production rest on three pillars: throughput and waste minimization, cost control across the lifecycle, and agility in product configuration. When these pillars stand on a stable platform with solid service and support, manufacturers gain a durable foothold in a market defined by convenience, hygiene, and evolving consumer expectations. For readers seeking a primer on how such platforms are deployed and scaled, the disposable tableware category offers a practical lens into real-world applications and outcomes.

Within the broader narrative of disposable tableware beyond this chapter, the ecosystem continues to evolve as materials science, automation, and digital monitoring converge. For readers exploring broader product families and related applications, the industry has built an expansive canvas where forming technology meets branding, logistics, and sustainability. If you want to explore how different product formats fit into the same processing backbone, the disposable tableware category provides a useful cross-reference for practical, market-ready configurations. Discover more in that category to see how a common platform can support a diverse portfolio without sacrificing efficiency or reliability.

External resource for further reading on automated forming systems and how they are positioned in global manufacturing can be found here: External resource on automated forming systems.

From Mold to Mitigation: The Hidden Footprint of ODM 6oz Cup Manufacturing

The environmental footprint of disposable tableware begins long before a consumer takes a drink or a dip of sauce. In this chapter, we follow the arc from raw material choice and mold design to end-of-life realities, tracing how an ODM-style 6-ounce cup machine for disposable bowls fits into a broader environmental system. The machine’s role is to translate a resin into a usable container, and the choices made at each stage—feedstock, energy input, shaping dynamics, and post-use fate—set the stage for a lifecycle with both operational efficiency and measurable ecological costs. The discussion here does not merely catalog emissions; it threads together resource chemistry, energy intensity, waste management challenges, and policy currents to illuminate why even highly efficient equipment must be evaluated against principles of sustainability that extend beyond the factory floor. It is the interplay of design freedom, production pressure, and end-of-life infrastructure that ultimately defines whether a production line remains a force for progress or becomes a perpetual maintenance problem for communities and ecosystems alike. The machine in question, capable of forming at a maximum speed of thirty-five cycles per minute and requiring a pneumatic pressure range of six to eight hundred kilopascals, sits at the convergence of demand for convenience and the demand for a healthier planet. That pair of numbers—cycle rate and pressure—are not merely technical specifications; they are levers that shape energy use, material waste, and the potential for design optimization. When operators push for higher throughput to meet growing consumption, energy intensity tends to rise in proportion, and small inefficiencies compound into larger environmental costs. Conversely, careful process control, maintenance, and smarter mold design can tamp down energy use while preserving product integrity. The absence of explicit power specifications in the available data does not absolve the industry from accountability; it highlights a critical gap that manufacturers and policymakers alike must address. Without a transparent accounting of electricity or thermal energy consumption, it is difficult to benchmark improvements or compare scenarios that balance cost with ecological responsibility. Yet even as energy questions loom large, the most consequential environmental questions arise from material choices and end-of-life pathways. Disposable 6-ounce cups and the accompanying 0.75-ounce sauce cups are often fashioned from conventional polymers such as polypropylene and polystyrene, resins derived from fossil fuels that carry a climate bill long after the cups leave the production line. The environmental narrative extends beyond the factory into the broader system of resource extraction, resin processing, and the energy mix that powers polymer manufacture. In a world where the plastics sector has been under scrutiny for energy intensity and greenhouse gas emissions, the shift toward resin choices and product design—an ongoing conversation in 2026—reflects an industry compelled to rethink life-cycle sustainability. The lifecycle of a disposable cup passes through three major gates: feedstock origin, manufacturing energy and emissions, and end-of-life fate. Each gate interlocks with the others. In terms of feedstock, the reliance on non-renewable resources remains a central concern. Petrochemical feedstocks used for polypropylene and polystyrene underpin a linear model whose environmental damages include not only greenhouse gas emissions but also the risks of spills, habitat disruption, and resource depletion. While resins have become cheaper and more versatile, their extraction and processing require substantial energy and generate emissions that accumulate across the supply chain. The 2026 European and global assessments repeatedly flag the energy-intensive nature of conventional plastics production and the need for more sustainable resin choices. The manufacturing stage amplifies these concerns. The process of blowing, shaping, cooling, and cutting cups demands precise energy management and equipment reliability. The cited machine’s requirement for specific pneumatic pressures to drive mold action and forming cycles emphasizes how process conditions translate into energy footprint and material quality. When a machine operates at high speeds, the energy demand climbs, but so does the potential for optimizing cycle times to reduce wasted heat, idle power, and material scrap. Operators face a balancing act: maximize throughput to lower per-unit energy costs, or throttle production to minimize heat and polymer loss. The reality is nuanced. Efficient control systems and well-tuned molds can reduce scrap and rework, delivering a smaller environmental toll per cup even at higher output. Yet the absence of explicit power data remains a blind spot in calculating total energy use and the corresponding carbon footprint. The post-consumer phase of these cups adds another layer of complexity. The problem of end-of-life management for disposable cups is not merely about whether the resin is recyclable; it is about whether the waste management infrastructure can handle it. Polystyrene and polypropylene cups are often challenging to recycle through municipal programs due to contamination, market volatility for recycled resin, and the economics of collection and sorting. Even alternatives that appear more sustainable on paper, such as plant-based polylactic acid (PLA) resins or paperboard with plastic liners, introduce new disposal complexities. If PLA is not properly composted in industrial facilities, it can persist in landfills and contribute microplastic release over time. In practice, the environmental performance of a disposable cup hinges on the alignment of disposal infrastructure with product design. The European Environment Agency’s 2025 assessment underscores how regional waste trends interact with policy and consumer behavior, painting a picture of rising plastic waste, uneven recycling rates, and the evolving regulatory landscape. The real-world outcome depends on whether policymakers, manufacturers, and waste managers cooperate to close loops and reduce leakage into the environment. The lifecycle perspective invites a broader discussion of alternatives and improvements. One path is the circular economy approach: designing products for reuse or extended life, designing for material recovery, and expanding the range of recyclable or compostable resins. For an ODM-style producer, this translates into three practical avenues. First, material innovation must go hand in hand with design for recycling. This means selecting resins and additives that facilitate sorting and recovery and designing the cup to minimize mixed-material barriers that complicate recycling streams. Second, the production line itself should be adaptable to multiple resin systems and to modular mold configurations so that changes in resin choices or product formats do not require a full plant retrofit. A flexible line reduces the risk of becoming stranded with obsolete tooling, a cost that falls directly on the environment in terms of wasted energy, scrap, and capital. Third, end-of-life partnerships become a strategic asset. Collaboration with waste-management providers and municipalities can enable pilot programs for curbside recycling of thin-walled cups or for industrial composting of PLA-based components in places where such facilities exist. Such collaboration also informs better product design, as feedback from the waste stream highlights which features hinder recyclability and which design elements promote easier separation of components. Beyond these design considerations lies the broader policy context. The global trend toward phasing out non-biodegradable single-use plastics is accelerating in many jurisdictions. Bans and restrictions on certain cups lead to substitution with paperboard or other alternatives. While these substitutions may reduce some direct plastic residues, they often introduce other environmental costs, such as deforestation pressures from paper production or energy-intensive processing. The overall sustainability of alternatives depends on how they are produced, transported, and disposed of, and whether recycling or composting infrastructure can accommodate them efficiently. The key takeaway for manufacturers using an ODM 6-ounce cup machine is that sustainability demands an integrated strategy. This means looking beyond unit cost and cycle rates to consider life-cycle impacts, from raw material extraction to end-of-life processing. It also means embracing transparency in energy accounting, material sourcing, and waste outcomes, so that producers, customers, and regulators can assess true environmental performance. In practice, this requires a shift in how success is measured. Rather than focusing solely on production speed or per-unit production costs, producers should track metrics that capture energy intensity per cup, carbon footprint per kilogram of resin, and recycling or composting rates at end of life. Such metrics enable meaningful comparisons across resin systems and process configurations and support evidence-based decisions about where to invest in improvements. The discussion here is not a critique of the market’s need for convenient packaging but a call for accountability. The materials and equipment that enable disposable cups can be part of a smarter, more resilient system if they are designed with end-of-life realities in mind. For ODM manufacturers, this implies committing to a blend of practical steps: adopt design-for-recovery principles in mold development; pursue resin diversification to enable recycling-compatible streams; implement energy-management practices on the shop floor that reduce peak demand and improve overall efficiency; and actively participate in pilot programs and partnerships that test new end-of-life pathways. When these practices align, the environmental footprint of a disposable cup becomes a matter of design choices, process optimization, and the strength of the waste-management ecosystem around it, rather than a single factor such as the speed of production. The broader narrative of this chapter emphasizes that the problem is systemic. The machine’s efficiency is meaningful only when the inputs and outputs fit into a coherent cycle that minimizes resource use and maximizes recovery. The internal linking to the wider ecosystem, via resources such as the disposable-tableware category, helps place these manufacturing decisions within a network of related products and practices that collectively shape the sustainability of single-use tableware. For readers seeking a practical entry point into responsible procurement or process planning, the disposable-tableware category provides a straightforward way to explore options that balance convenience with environmental responsibility, and it can serve as a starting point for conversations about material choices and end-of-life strategies. To situate the discussion in a real-world policy and market context, consider how regional waste-management capabilities influence the viability of certain resins and products. In regions with advanced recycling infrastructure, the environmental cost of a given cup may be mitigated by high recovery rates and efficient sorting technologies. In areas where recycling remains limited, the same cup can become a persistent contaminant, elevating the importance of design for recyclability and the adoption of alternative resins. The interplay of policy, market demand, and technical capability thus determines where the benefits and drawbacks of ODM-based production align most closely with environmental sustainability. The questions that follow are not merely technical; they are strategic. How can an ODM producer balance speed, flexibility, and resilience with a commitment to reducing greenhouse gas emissions and waste leakage? Which resin pathways offer the best compromise between cost, functionality, and end-of-life performance? How can collaboration across the supply chain—from raw material suppliers to waste-management facilities—generate closed-loop opportunities that transform single-use cups from a symptom of convenience into a demonstrable component of a circular economy? These are not abstract debates. They are the practical trials that determine whether the deployment of a high-speed forming machine yields a net positive impact for communities and ecosystems. In this sense, the environmental concerns surrounding ODM 6-ounce cup manufacturing are not merely concerns about pollution or waste; they are a test of how well industrial processes can adapt to a future in which resource scarcity, regulatory expectations, and consumer preferences increasingly converge on sustainability. The insights offered by contemporary environmental assessments remind us that no single intervention—be it material substitution, process optimization, or improved recycling infrastructure—alone resolves the challenge. Instead, progress arises from integrated strategies that connect resin choice, machine operation, product design, waste-management capacity, and policy incentives in a coherent, forward-looking framework. As the chapter closes, the reader is invited to imagine a pipeline in which a cup cycles through production, use, recovery, and reuse or safe disposal with minimal loss and maximum value recovered. The ODM cup machine sits at the heart of that pipeline, not as an isolated piece of equipment, but as a component of a system that must be designed with ecological intelligence from the outset. In practice, this means nurturing transparency around energy and material flows, embracing flexible manufacturing that accommodates alternative resins and product formats, and cultivating partnerships across the value chain to strengthen end-of-life options. It also means recognizing that policy signals matter: regulation and incentives can steer technologists and managers toward choices that reduce emissions and boost recovery rates without compromising the functionality consumers expect. Reading the latest regional assessments, such as the European Environment Agency’s synthesis of plastic-waste trends, provides a benchmark for where the world stands and where further improvements are most needed. For those who want to explore related product categories and concepts that intersect with disposable cups and tableware, the broader catalog of disposable-tableware offerings offers a useful starting point for evaluating alternatives and understanding market dynamics. This chapter—while focused on the environmental concerns associated with the ODM 6-ounce cup machine for disposable bowls—speaks to a larger conversation about how industrial practices can adapt to environmental accountability without sacrificing innovation or economic viability. In the end, the path forward lies in the ability to align design, process, and policy in a way that reduces harm while preserving the benefits of convenient, hygienic packaging. The challenge is not merely to make small improvements but to rethink systems in which production, consumption, and waste are in dialogue with one another, rather than operating on separate tracks. Readers who seek to deepen their understanding can consult external resources that contextualize plastic waste and how regions respond to these pressures. For an external resource, see https://www.eea.europa.eu/publications/plastic-waste-2025, which provides a contemporary view of waste generation, recycling rates, and environmental impacts across Europe. This chapter’s synthesis aims to equip practitioners with a grounded sense of where to focus efforts, why certain strategies are more resilient than others, and how a single machine can participate in a broader, more sustainable manufacturing ecosystem by embracing material flexibility, energy-conscious operation, and proactive collaboration across the supply chain.

Chapter 4: Accelerating Through Demand—How ODM 6oz Cup Machines Do More Than Form Disposable Bowls

The market for disposable tableware has matured beyond a simple need for a lightweight offering. It sits at the core of brand storytelling, supply chain resilience, and factory floor choreography. The ODM plastic 6oz cup machine, engineered to form small, everyday containers, embodies this shift. With a maximum cadence of 35 cycles per minute, it translates an initial design into a steady stream of cups that fit the pace of contemporary cafes, convenience stores, and takeout windows. The machine relies on a precise pneumatic window of 0.6 to 0.8 MPa, a range that sustains reliable mold filling and smooth forming without overstress. While the electrical footprint is not always laid out in every spec sheet, energy use and uptime remain central to profitability in a market that prizes speed and reliability. In this environment, the ODM approach becomes more than a naming convention; it is a blueprint for aligning equipment capabilities with the daily realities of high-volume, time-sensitive packaging operations.

Sustainability hangs as a constant in the evolution of disposable tableware. Regulators, retailers, and customers increasingly seek packaging that reduces environmental impact without compromising safety or performance. This pressure motivates manufacturers to broaden material compatibility beyond conventional PET and PP toward bio-based or compostable alternatives such as plant-derived polymers. The ODM 6oz platform is evolving to accommodate this shift, offering adaptable tooling and process controls that allow operation with multiple resin families while maintaining the required wall thickness, rim integrity, and sealing performance. The practical implication is meaningful: brands can pursue sustainability goals across their portfolios without sacrificing line speed or product uniformity. The availability of fast prototyping and sample runs supports careful material qualification, enabling producers to observe real-world behavior of a new material under standard cycle times and trim specifications before committing to full-scale conversion. In this sense, the ODM machine serves not only as a forming device but as a gateway to responsible packaging strategies that align with regulatory expectations and corporate values.

The on-the-go economy has become a defining driver of product design and process engineering. The 6oz format is ideally suited for single servings of cold beverages, from coffee and iced drinks to craft beers during promotions, as well as small portions of sauces or condiments alongside snack items. The compact shape supports efficient storage on crowded shelves and in back-of-house spaces, while the stackable geometry simplifies logistics from warehouse to point of sale. In practical terms, speed and automation translate into tangible advantages: quick changeovers, consistent cup geometry, and reduced labor costs per unit at scale. Modern forming lines increasingly integrate forming, trimming, and optional imprinting in a single flow, enabling a single operator to oversee multiple stations across a production lane. This convergence of tasks becomes a strategic asset for brands that depend on reliable throughput to satisfy peak demand periods without sacrificing accuracy on branding, geometry, or material integrity. The result is a system capable of supporting not just routine orders but also seasonal campaigns that require rapid deployment of new designs with predictable performance across thousands of cycles.

Technology reshapes what it means to specify and procure these lines. Contemporary ODM configurations blend forming with smart controls, real-time monitoring, and energy optimization. The possibility of imprinting logos or seasonal graphics on the cup during forming shortens downstream processing and ensures a consistent customer experience from first impression to last sip. The mention of imported components from leading markets reflects a broader trend toward sophisticated, precision-driven equipment that balances high performance with cost efficiency. The platform becomes a modular evolution rather than a fixed device: it can adapt to material shifts, branding changes, and regulatory updates while preserving repeatability and part life. This versatility matters most when a brand needs to pivot from a generic offering to a distinctive line that carries a campaign message, a corporate logo, or a limited edition motif without interrupting production. The machine thus serves as a bridge between design intent and market realities, translating a concept into a tangible object that gracefully carries beverages and sauces through diverse service contexts.

Beyond the plant floor, geography has a decisive influence on availability, pricing, and speed to market. China remains a dominant hub for plastic tableware manufacturing, leveraging deep experience in PET products and a robust supplier ecosystem. ODM providers there offer rapid prototyping and scalable production, often accompanied by pricing structures that favor distributors and end users seeking global reach. The landscape includes generous incentives like bulk discounts and territory protections for partners, which help stabilize channel performance even when raw material costs fluctuate. The trade-off is the need for careful vetting, given the complexity of quality control and the imperative to meet safety and food-contact standards across regions. Yet the combination of manufacturing scale, process flexibility, and an ODM framework yields a compelling path for brands aiming to reach multiple markets quickly. A line configured to specific 6 oz and 0.75 oz formats, compatible material options, and a distribution plan that covers regional demand can be deployed with manageable lead times and consistent results across batches. In this reality, the factory floor becomes a dynamic interface between design intent, supply chain strategy, and consumer behavior, with the cup as the everyday conduit.

Brand identity is increasingly inseparable from the physical form and surface finish of disposable cups. The capacity to add logos and branding during production without a separate prepress stage accelerates time to market. The seven-day turnaround after payment is frequently highlighted in ODM narratives, a feature that matters for seasonal campaigns, event sponsorships, and regional promotions. This speed is not mere marketing; it signals an integrated workflow in which molds, decoration systems, and downstream packaging are aligned to support rapid changeovers. For producers, that means lower capital risk in prepress and faster capacity to experiment with messaging, colors, and finishes. It also empowers brands to test compostable liners, recycled content, or barrier improvements without compromising the user experience. The interplay of material science, tooling design, and branding strategy reveals how the ODM platform influences not only product performance but also the perception of a cup as a trusted vessel within a brand ecosystem. The result is a more resilient offer that can adapt to evolving consumer expectations while preserving the consistency that is essential to customer satisfaction.

Investors and operators evaluating these lines should view them not as a single-purpose machine but as a scalable asset that enables a company to translate ideas into reliable, repeatable packaging at scale. The value lies in speed and flexibility: a line that can handle a standard 6 oz cup and then shift to a logo enhanced variant within the same shift reduces downtime and accelerates revenue recognition. The economics extend beyond the purchase price to include operating costs, maintenance, and energy use. High cycle rates reduce unit labor, while smart controls and predictive maintenance minimize unplanned downtime. Material versatility broadens the potential customer base, allowing brands to respond to regulatory shifts and consumer preferences without sacrificing performance parity. The ODM approach also mitigates risk by providing a pipeline for rapid prototyping, robust quality assurance, and a global supply network that supports contingency planning. In short, the ODM 6 oz cup machine is not merely a forming instrument; it is a platform for ongoing experimentation, a lever for brand storytelling, and a backbone for a packaging strategy that must navigate sustainability, convenience, and market volatility with equal poise. The practical takeaway for executives is clear: invest in a line that can adapt as consumer journeys evolve, and treat the machine as a living component of the brand’s overall packaging narrative.

For readers seeking a broader perspective on how these systems fit into the packaging landscape, exploring the disposable tableware category offers a useful context that aligns with the themes of customization, supply chain agility, and sustainability. disposable-tableware provides an overview of related products and materials that intersect with the production capabilities described here. This connection helps illuminate how a single forming line can support a family of products designed for different service environments while maintaining a coherent brand footprint. As the chapter advances, the focus shifts from what the machine can do in principle to how brands leverage its capabilities within the larger packaging ecosystem, balancing design ambition with practical constraints on cost, lead time, and regulatory compliance. The next exploration will build on this understanding by examining how suppliers calibrate risk management and supply chain resilience when rolling out ODM configurations across multiple markets, ensuring that a single technology choice remains aligned with a broader strategic plan.

External reference for further technical context on high speed plastic cup forming can be found at an industry resource that profiles automatic cup forming lines and related equipment. This external resource provides additional specifications and real-world performance data to complement the narrative above: https://www.alibaba.com/product-detail/High-Speed-Automatic-Plastic-Disposable-Cup-Machine_1600578857891.html

Final thoughts

The ODM Plastic 6oz Cup Machine for Disposable Bowl is more than just a manufacturing tool; it represents a strategic investment for industries relying on disposable tableware. By understanding its technological, economic, and environmental implications, businesses can not only streamline their operations but also align with market trends and consumer preferences. As you consider integrating this machine into your production processes, remember that enhanced efficiency, cost-effectiveness, and a commitment to sustainability can set your brand apart in a competitive landscape.